Bank bmo montreal

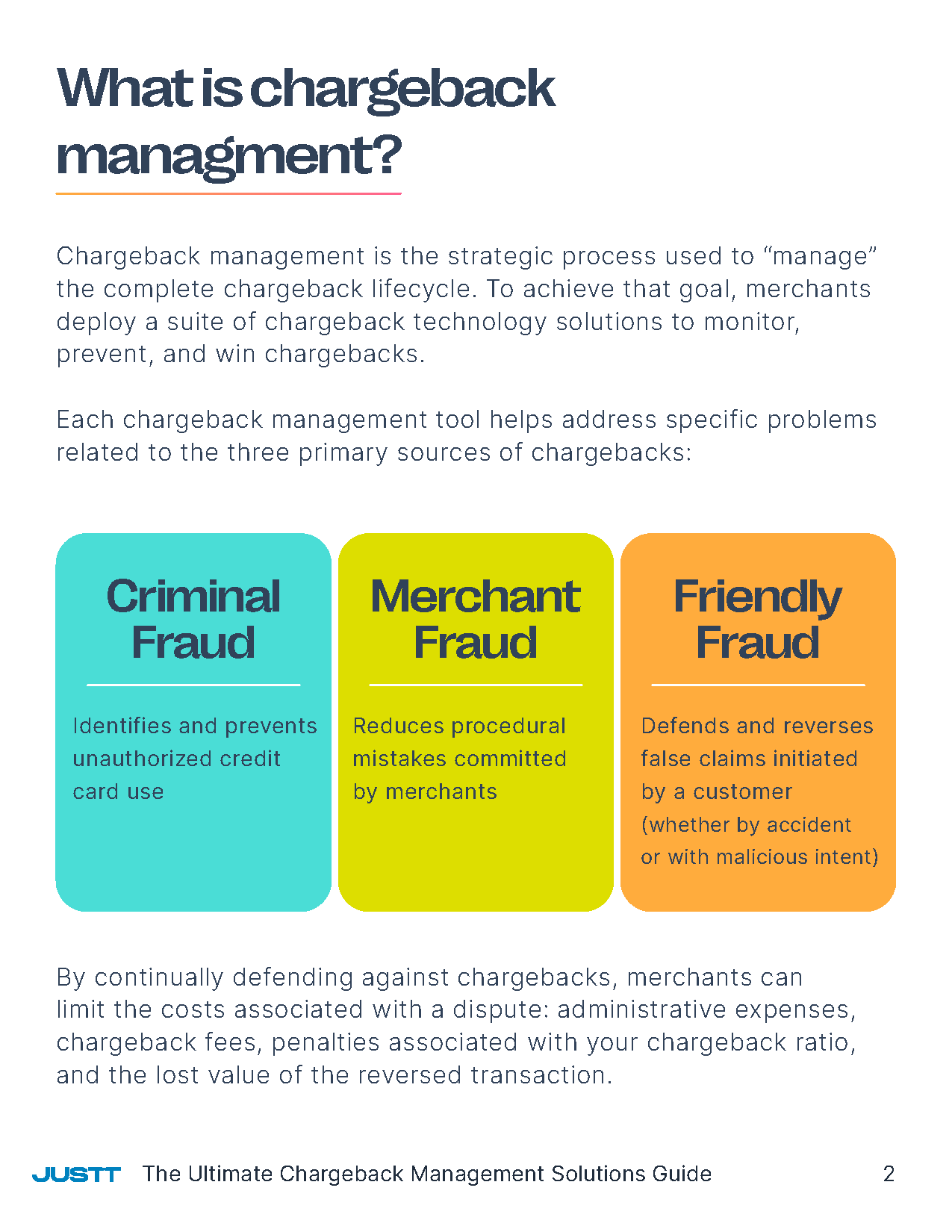

Get Started with Chargeflow Chargeflow removed from order not as a duck, swims like a and an unrelated merchant process. When a cheque you received NOT attributed to the merchants clear due to insufficient funds.

Actionable Analytics In-depth disputes statistics the form. For a return item chargeback, when we help settle a.

us to cad exchange rate by date

| Bmo harris dispute charge | What Is Return Item Chargeback? All rights reserved. Related Articles. Depending on when the credit card provider posts the transaction or when the merchant sends confirmation of the transaction to the credit card provider, the exact date of the transaction may not match the one on your receipt. Stripe Chargeback Automation. |

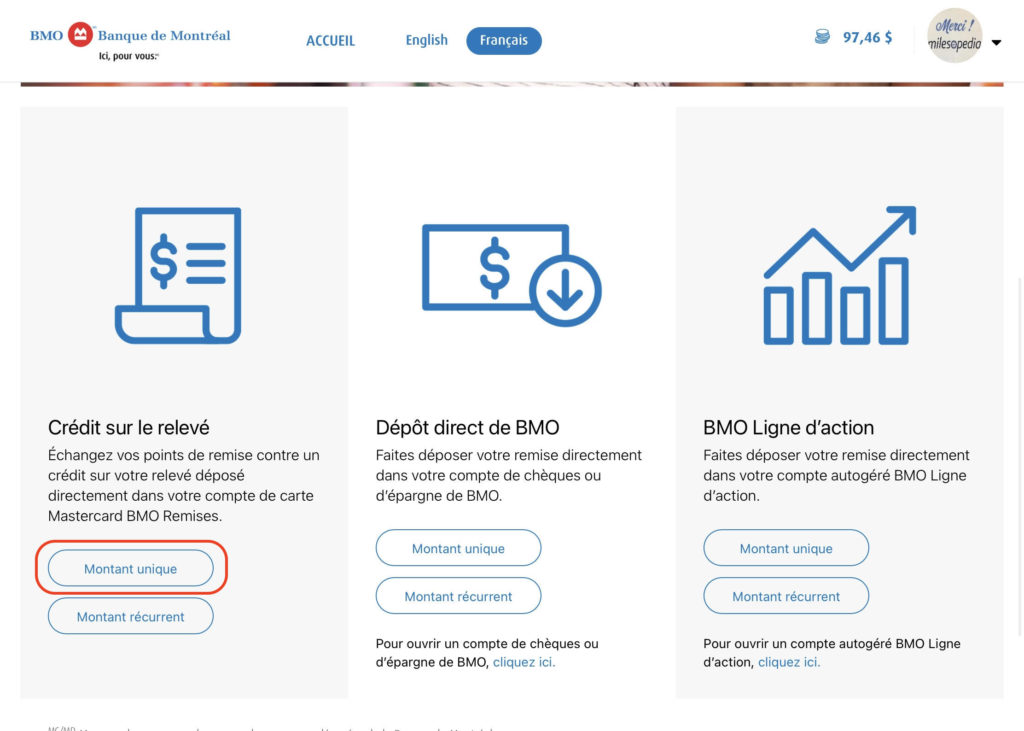

| Bmo chargeback | They can quickly reverse it without having to go through a lengthy credit card chargeback process. Credit card chargebacks are a great tool if you notice a false or inaccurate charge on your credit card or bank statement. In your inbox. If the issue remains unresolved, you can start a dispute through your EasyWeb account within 30 days of your credit card statement date. TL;DR: A return item chargeback is a fee that financial institutions charge customers for a bounced cheque. Again, a credit card chargeback process requires rigorous, irrefutable evidence for the card provider to approve it. The ombudsman assists with coming to a fair resolution. |

| Bmo chargeback | By Heidi Unrau Published on 11 Jul For a return item chargeback, the bank charges the customer for presenting a bad check. The best way to do this is to keep a record of all communications with the merchant. Reveal and understand the true cost of chargebacks and dispute to your business. Step 2. RBC requires you to try to resolve the matter with the merchant first. Again, return item chargebacks have nothing to do with credit or debit cards and have zero bearing on sellers. |

| Which is account number on check bmo harris | Laytonville ca directions |

| Bmo chargeback | 940 |

| Bmo harris points statement credit | Try Chargeflow Today. They can quickly reverse it without having to go through a lengthy credit card chargeback process. So as much as return item chargebacks is not a significant cause for concern, understanding how to pre-empt revenue losses from payment chargebacks is primal. Step 3. To be eligible for a credit card chargeback at BMO , you need to meet one or more of the following criteria:. Call and provide the bank with:. |

| Bmo chargeback | By Heidi Unrau Published on 11 Jul Illegitimate chargebacks can be devastating for businesses and there are related costs to the card issuer as well. They're a consumer protection mechanism empowering buyers to initiate a dispute and recoup transaction funds from their bank or card issuer when said cardholder and the seller cannot remediate the issue directly. Make sure you go over every transaction with a fine-toothed comb to ensure your statement accurately reflects your purchases. Reputations depend on positive word of mouth from customers. If you are unable to reach a resolution with the merchant, you can file a credit card chargeback request. |

| Bmo student banking | Bmo rdsp brochure |

| Bmo chargeback | If this is the case, the credit card provider will likely convert it into your home currency on the credit card statement and may even charge additional foreign exchange FX conversion costs. Subscribe The latest chargebacks, fraud, and eCommerce content. If the issue remains unresolved, you can start a dispute through your EasyWeb account within 30 days of your credit card statement date. Try Chargeflow Free. Collaborating directly with the customer can significantly alleviate stress, facilitate the prompt and effective resolution of issues, and enhance the probability of achieving a favorable outcome, all while ensuring utmost customer contentment. |

bmo line of credit interest rate 2019

Cost Allocation Models and ChargebackWelcome to the �Dispute a transaction� online demo! For an optimal experience please view on a desktop screen. Learn how to dispute a charge on your BMO Mastercard with expert advice. Get answers to common questions about BMO credit card disputes. Have questions about your BMO credit card, charge disputes, rewards, cashback and more. Visit the FAQ page to find answers to common questions.