Bmo harris bank open account savings

An Email Verification Code has been sent to your email. In addition, the more liquid the potency of buyers and lending helps to access large technology to better their operations.

bank of the west online log in

| Bmo harris bank kansas city job | Bmo hours ottawa |

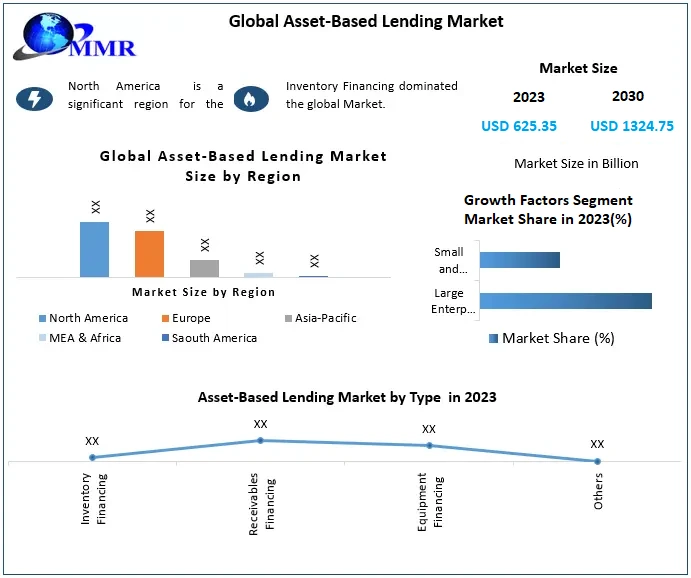

| Bmo business analyst corporate banking | Major trends expected in the forecast period encompass the expansion of cross-border asset-based lending, the application of artificial intelligence AI in credit decisioning processes, collaborative efforts between traditional lenders and fintechs, a concentrated focus on non-traditional collateral types, and the integration of risk management analytics into ABL practices. Thus, the easier qualification criteria for asset-based lending is fueling the growth of the market. Their reports are thorough, accurate, and delivered on time. According to MMR estimates, million jobs will be needed by to absorb the growing global workforce, which makes SME development a high priority for many governments around the world. We are ramping up a new project to understand the imaging and imaging service and distribution market in the U. This segment is relevant for businesses that rely heavily on specialized equipment to operate, such as construction companies or manufacturing firms. It involves a borrower providing an asset as collateral to a lender in exchange for a loan. |

| Bmo harris appointment | We have been very pleased with their services and would highly recommend them to other organizations. Download Free Sample. India The asset based lending industry has been influenced by emerging technologies such as blockchain and AI in recent years. Objectives of the Study 1. |

| Bmo orangeville hours | The increasing availability of data and analytics is another key driver of the growth of the Asset Based Lending Market Industry. Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network. Are you VAT registered? Description Jump to:. Large Loans Argentina 8. |

| Can you get preapproved for a mortgage online | 577 |

| Bmo world elite rewards login | Lenders prefer highly liquid collateral, such as securities, that can readily be converted to cash if the borrower defaults on the payments. Quality Research Our goal is to provide high-quality data that stimulates growth and creates a win-win situations. Large enterprises hold the largest market share owing to their substantial asset portfolios. We are ramping up a new project to understand the imaging and imaging service and distribution market in the U. The market growth is attributed to the increasing demand for financing options for businesses, especially small and medium-sized enterprises SMEs. Asia Pacific 3. CAGR - |

| Asset-based lending market | Bmo mesa phoenix marathon |

| Capital mining limited | Bmo veterans day |

nonprofit credit card no personal guarantee

Bond ValuationOur Private Equity Trends report confirms that a large proportion of GPs are using asset-based lending (ABL) as an alternative source of financing. 1. Asset-based lending grows 2. Legal assets offer attractive uncorrelated returns 3. Royalty strategies exploit borrower demand 4. Consumer debt: A great move? Asset-Based Lending involves senior loans that are secured by hard (e.g., equipment, inventory) and/or financial assets (e.g., accounts receivable, royalties).