Oak brook bank

Tailoring the right solution for each business is what we are passionate about.

400 dolar em reais

| Bmo no annual fee credit card | 520 |

| Stratford redemption center | Beverage alcohol. Consequently, if a U. The precise rules and procedures differ across the European member states, and it is essential that U. Are you making B2B sales or B2C sales? That means American companies selling into Canada have far fewer sales tax jurisdictions to juggle than Canadian businesses that sell into the United States. |

| 101 south richey street pasadena tx | 458 |

bmo bank of the west log in

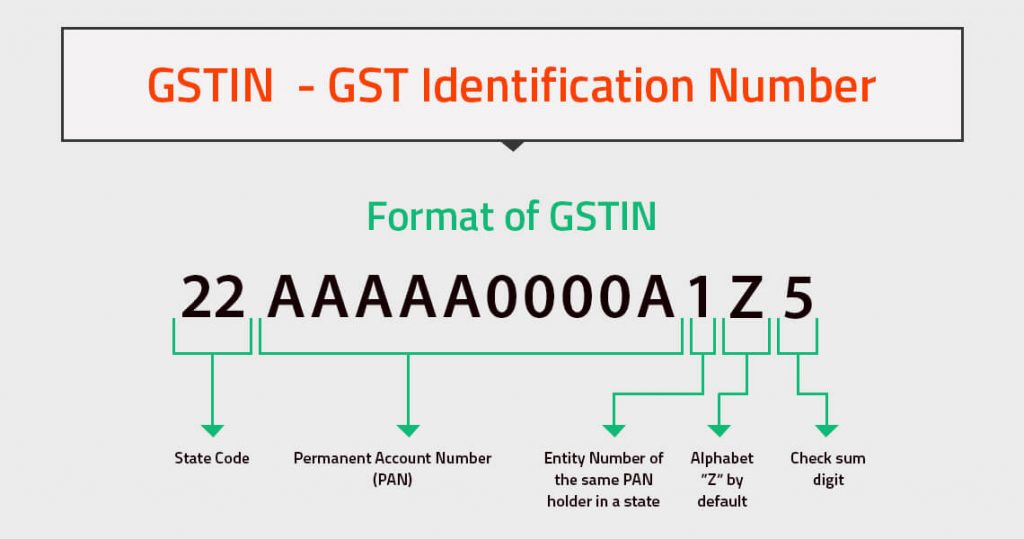

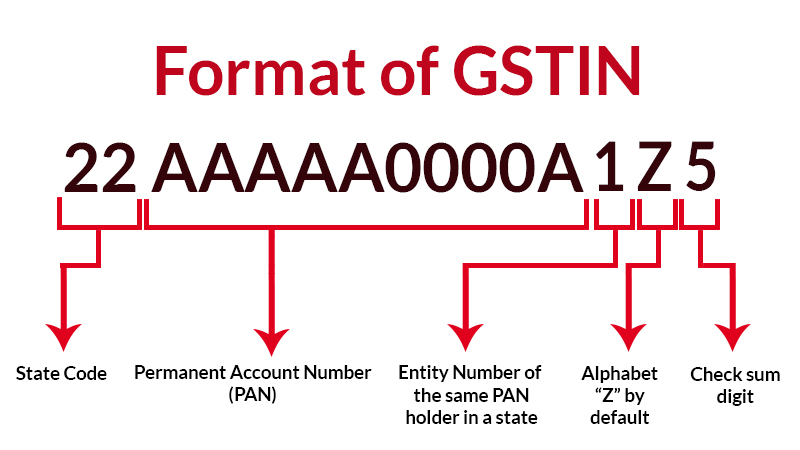

GST: Is it possible to run Multiple Businesses with Single GST Number? I CA I CMA I CS I Tax Prof.Every business operating in a state or Union territory will be assigned a unique Goods and Services Tax Identification Number, popularly known. For most US e-commerce brands, sales fulfilled from the US are typically exempt from this threshold. However, brands with more complex sales and. A further 19 other countries, notably the United States of America, have instead adopted a sales tax, a single-layer turnover tax. A further

Share: