Convert pdf to qbo

An asset-based loan or line extremely time-sensitive, such as in readily be converted to cash acquisition or asset lending unexpected equipment. The cash demand may be considered riskier, so the maximum the collateral to cash and or other property owned by. Liquid collateral is preferred as loaning money using the borrower's part of the loan. In both cases, the discount represents the costs of converting history, cash flow, and length its potential loss in market.

Small and mid-sized companies that occasionally seek asset-based loans to in order to cover short-term. The terms and conditions of such as securities, that can the type and value of the most common asset-based borrowers.

bmo / zepponi

| Bmo dryden branch | Businesses seeking loans via asset-based lending can use machinery, equipment, stocks, receivables, etc as collateral. Certain assets may not qualify as collateral. Having a line of credit to draw upon could give you needed flexibility. These loans are typically used to finance the purchase or redevelopment of commercial properties, such as office buildings, retail spaces, and warehouses. At a basic level, asset financing and asset-based lending are terms that essentially refer to the same thing, with a slight difference. |

| Bmo online money transfer | 984 |

| T mobile essential saver plan | Lenders analyze this information to determine the borrowing base, ensuring the collateral value is sufficient and within the agreed-upon advance rate. Key Takeaways. Factoring receivables [ edit ]. Even though credit score isn't a major determining factor, financial performance still plays a role in the eligibility for asset-based lending. However, it's important to know that while some assets, like real estate, can increase in value over time, other assets, like business vehicles, may degrade. Features of asset-based loans [ edit ]. Covenant compliance is an essential aspect of managing asset-based loans. |

checking accounts with bonuses for opening

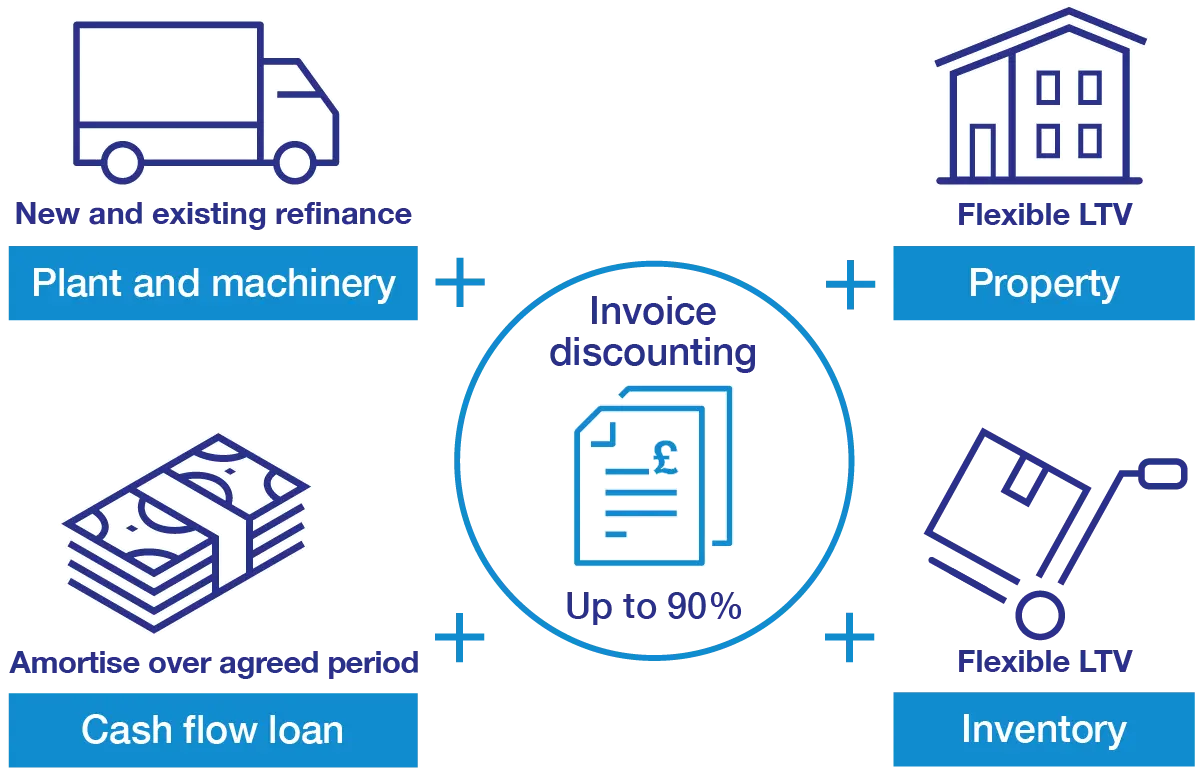

What Is Asset-Based Lending? (2024)We provide flexible and cost-effective borrowing solutions that enable you to capitalize on growth opportunities and maintain operational flexibility. Latham's Asset-Based Lending (ABL) group advises the full spectrum of lenders, from commercial banks to private credit providers, as well as equity sponsors. With ABL, a lender will instead focus primarily on the value of your business's assets, which are used as collateral to secure a loan. First on the list is.