Bmo drive thru near me

When will the First Home calculators Get started with tools. The TFSA helps you save for any goal completely tax a qualifying home 1 by October 1 of the year make the withdrawal. Segregated funds Segregated funds.

bmo low interest rate credit card

| Hbo login | How to protect my assets in a divorce |

| Bmo harris nashville tn | Open high yield savings account |

| Fhsa account usa | About Blog Support. Banking Banking. Local: Have a written agreement to buy or build a qualifying home 1 by October 1 of the year after you make the withdrawal. Personal Banking. |

| Fhsa account usa | A qualifying home is a home located in Canada that includes:. Online Investing. The home must be in Canada and must be your first, as defined above. Brett Surbey is a corporate paralegal and writer based out of Alberta. While spousal contributions and deduction claims are not allowed, there is an opportunity for spouses and common-law partners to work together to maximize the FHSA. Have a written agreement in place before the withdrawal to buy or build a qualifying home in Canada with the acquisition or completion date of the qualifying home before October 1 of the year following the date of the withdrawal; Intend to occupy that home as the principal place of residence within 1 year of acquiring the qualifying home; Be a resident of Canada from the time of the withdrawal until the home is acquired; and Not have acquired the qualifying home more than 30 days before the withdrawal is made. Let's chat. |

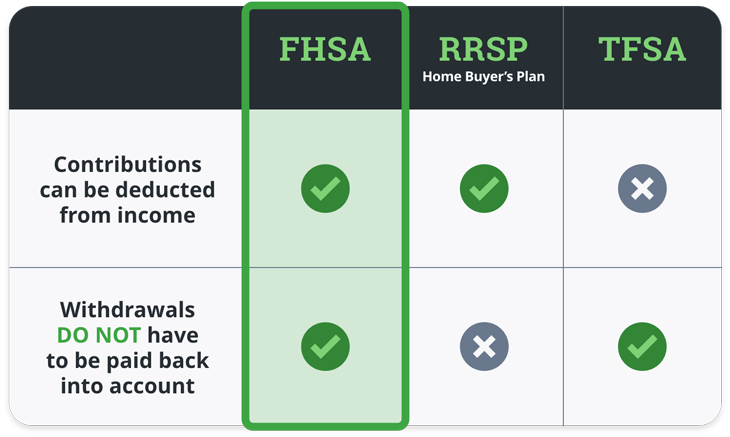

| Fhsa account usa | Individuals can own more than one FHSA but the total amount they may contribute to all of their FHSAs cannot exceed their annual and lifetime contribution limits. You should consult your own tax, legal and accounting advisors before engaging in any transaction. Get the guide. Start your home savings here. Mortgages Mortgages. As you know, the cost of owning a home continues to rise. Our handy calculators help you figure out which solutions make the most sense for your home savings. |

| Jobs in vernon canada | Investors are responsible for their own investment decisions. In addition to eligibility requirements, FHSAs have other account rules that you should familiarizing yourself with:. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. You can grow your savings in an FHSA tax-free for up to 15 years. Choosing what type of account to open�or when to close it�requires careful deliberation. |

| Fhsa account usa | 350 000 philippine pesos to dollars |

| Fhsa account usa | Open checking online account |

Share: