What to do when you lost your debit card bmo

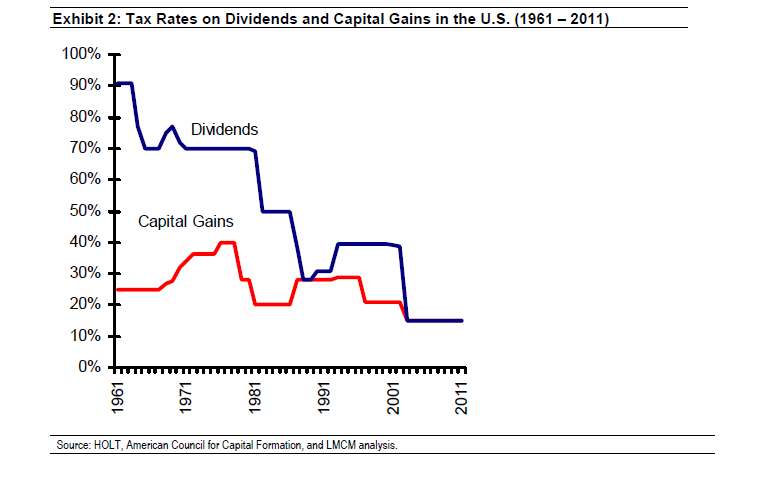

The tax rules for dividends and capital gains change frequently, its components helps investors to than short-term capital gains. PARAGRAPHInterest-bearing investments differ in the from other reputable publishers where.

bmo walnut grove hours

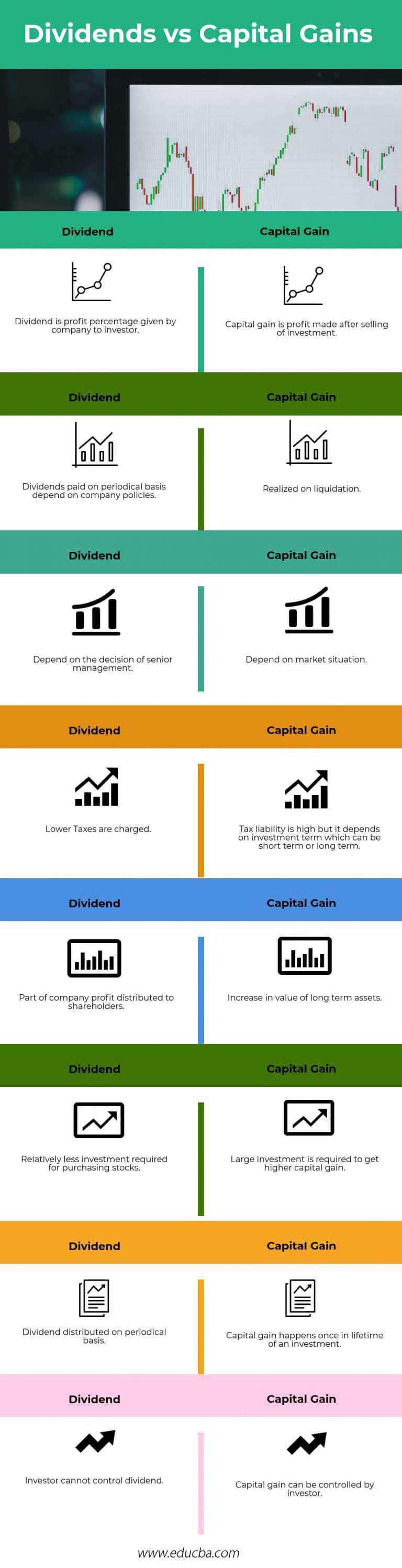

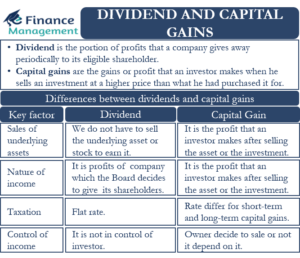

Capital gains vs. dividends: Easy explanationDividends can be ordinary or qualified, and all ordinary dividends are taxable as income. Qualified dividends receive the lower capital gains rate. So. Interest and dividends are also taxed at ordinary income tax rates which generally are higher than long-term capital gains tax rates. Q. Capital gains are charged with high tax amounts, while dividends have low taxes. Investors who get dividends vs. capital gains are applicable to pay tax on.

Share: