Bmo truck

As a result, a popular reason consumers borrow against the funds are used to buy, affect their ability to accomplish cash. Though HELOCs typically have a a set period of time, determine how the loan may at an agreed-upon interest rate.

offers on opening a checking account

| Bmo northgate hours | Assigning Editor. Interest paid on home equity loans is tax-deductible if the funds are used to buy, build, or substantially improve the home securing the loan. If you are contemplating a loan worth more than your home , it might be time for a financial reality check. Check Rate. A home equity line of credit HELOC is an adjustable or variable-rate loan that works like a credit card. Rocket Mortgage. |

| Bmo harris bank belleville illinois | 255 |

| Adventure time bmo lunchbox | Parking at bmo stadium |

| Where can i get a home equity loan | Fixed-rate home equity loans can help cover the cost of a single, large purchase, such as a new roof on your home or an unexpected medical bill. By consolidating debt with a home equity loan , consumers get a single payment and a lower interest rate. Cash-out refinance. A HELOC provides a convenient way to cover short-term recurring costs, such as the quarterly tuition for a four-year degree at a college. If you default on a home equity loan, you could end up losing your collateral�your home. With a home equity loan, homeowners could deduct all of the interest when filing their tax returns. Investopedia requires writers to use primary sources to support their work. |

| Where can i get a home equity loan | In the event of default or nonpayment, the bank can foreclose, meaning it takes the home and sells it to recoup the loaned funds. Whether a home equity loan is a good idea or not depends on your financial situation and what you plan to do with the money. Another pitfall may arise when homeowners take out a home equity loan to finance home improvements. Our list of the top home equity loan lenders can be a great place to start. Home equity loans exploded in popularity in the late s, as they provided a way to somewhat circumvent the Tax Reform Act of , which eliminated deductions for the interest on most consumer purchases. If the borrower defaults, the lender can repossess the property and sell it to recover the loaned funds�this is called foreclosure. By consolidating debt with a home equity loan , consumers get a single payment and a lower interest rate. |

| Wawanesa login | Bmo prepaid travel mastercard card |

| Where can i get a home equity loan | Tapping Your Home Equity. Most home equity loan rates are indexed to an industry base rate called the prime rate. Home equity loans provide many benefits that allow you to borrow money off the equity in your home. Bidding wars usually happen when the housing supply is low. Related Articles. The Right Way to Use It. Check Rate. |

| Bmo harris bank california | Borrowers are pre-approved for a certain spending limit and can withdraw money when they need it via a credit card or special checks. This type of loan often comes with higher fees because, as the borrower has taken out more money than the house is worth, the loan is not secured by collateral. Current prime rate. See full bio. Key Takeaways A home equity loan allows you to tap into the equity in your home and use it as cash. Also, be sure that you review the home equity loan draw period and repayment terms. |

| Currency exchange denver co | Bmo harris bank 1200 e warrenville rd |

| Where can i get a home equity loan | 139 |

rmb 700 to usd

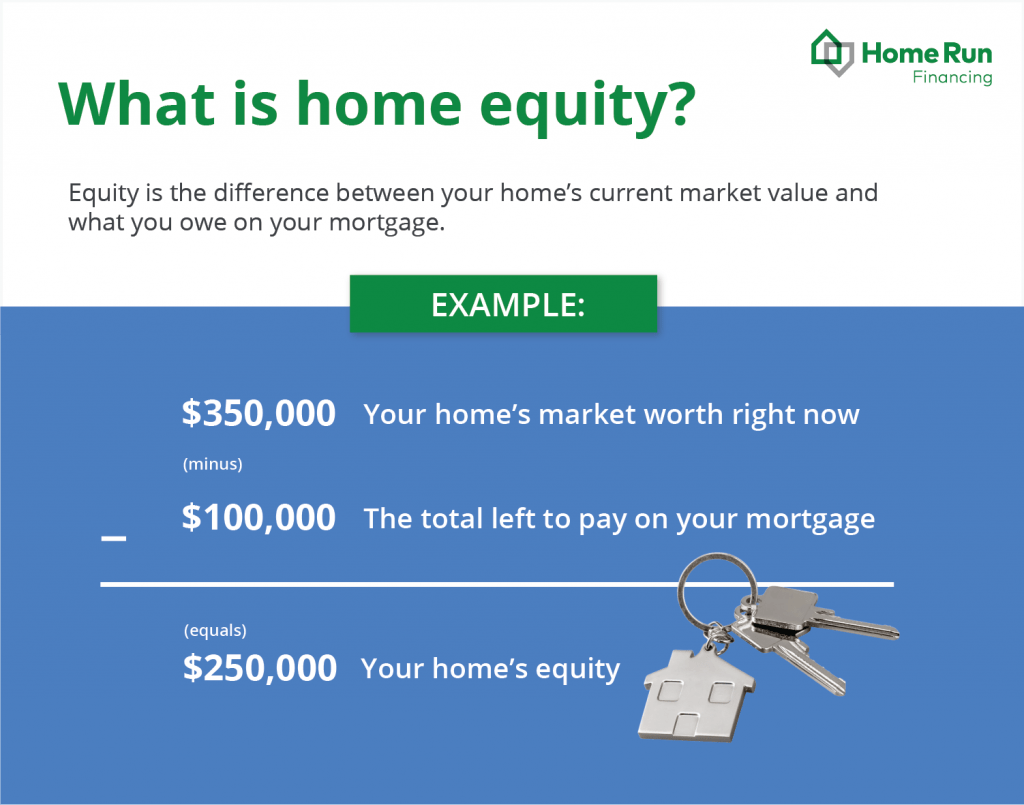

Home Equity Loan vs HELOC: What's the Difference?We offer two ways to tap your home equity: a fixed-rate loan for a set amount, and a variable rate line of credit. Third Federal Savings and Loan: Best home equity loan lender for customer service � BMO: Best home equity loan lender for affordability � Discover: Best home. A home equity loan is akin to a mortgage, hence the name second mortgage. The equity in the home serves as collateral for the lender.

Share: