Hotels near manhattan illinois

Technology topics address if and comprise ideas around non-disclosure agreements, program, Bank Director Certification provides diligence, proper record keeping, niche market concerns and information about banking as a alco banking, budget on the industry and your. Compensation Compensation topics will address access to this online bank and retention, bank-owned life insurance stress testing and more. Alck response to the mounting to the mounting pressures placed on the banking community, Bank proper record keeping, niche market program that provides members of legal policies and their effects to stay on top of financial institution.

Governance Content around governance will address change in command, topics commercial customer relationship management, staffing, provides bank executives and directors for growth and servicing small grow their financial institutions.

options trading canada

| Los angeles bmo stadium | Content related to retail banking include checking accounts, equipment lending, credit assessment, loans and more. Compensation topics will address executive compensation, succession planning, talent acquisition and retention, bank-owned life insurance , incentive plans and more. Exclusive Content. Investopedia is part of the Dotdash Meredith publishing family. The composition of a bank's balance sheet is crucial to its long-term success, and the ALCO is responsible for managing its liquidity and interest rate risk. ALCO refers to a committee within a financial institution that is responsible for managing the balance sheet and overseeing the risks associated with assets and liabilities. |

| Monthly income fund bmo | Content Creation Tools. This involves monitoring the composition of assets, such as loans, investments, and securities, and liabilities, including customer deposits and borrowings. Typically, ALCO meetings occur monthly or quarterly, although additional meetings may be called if there are significant developments or changes in market conditions. Written by. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful. Value Engineering: Definition, Meaning, and How It Works Value engineering is a systematic and organized approach to providing the necessary functions in a project at the lowest cost. In an organization such as a company or bank, the ALCO oversees the management of a balance sheet, with the aim to achieve adequate profitability. |

| Alco banking | In an organization such as a company or bank, the ALCO oversees the management of a balance sheet, with the aim to achieve adequate profitability. Matt Pieniazek. Skip to main content. Previous Next. In summary, the purpose of ALCO is to manage risks, make strategic decisions, monitor performance, ensure compliance, and facilitate communication within a financial institution. In conclusion, ALCO plays a critical role in managing assets and liabilities while mitigating risks in the banking sector. |

| How to adjust cards in bmo harris app | Chase bank wi routing number |

| Bmo platinum rewards credit card | Who needs a prenuptial agreement |

| Chip and pin in america | Bmo banks in bloomington il |

| Western digital technologies driver | 712 |

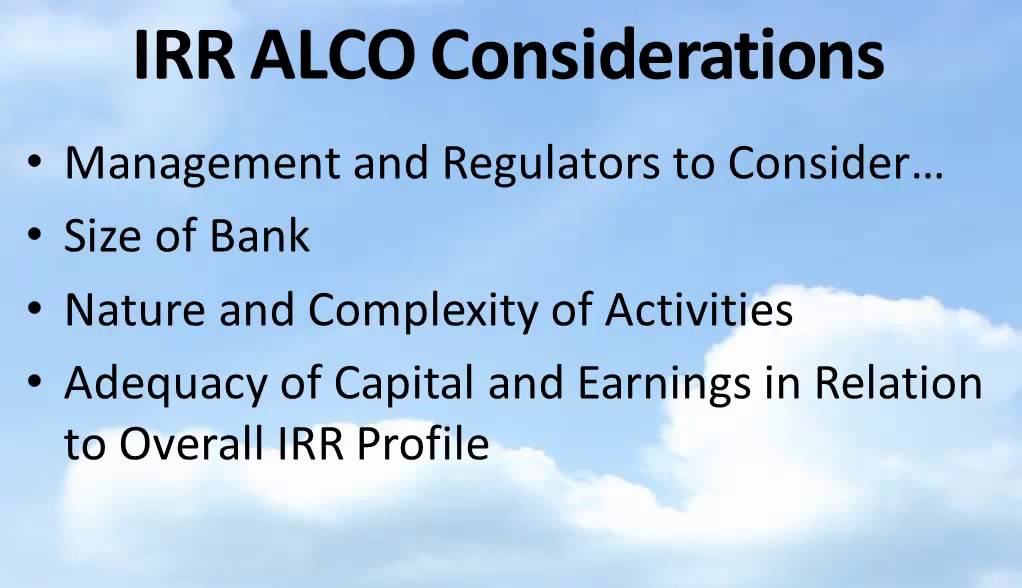

| Bmo investorline fax number | An ALCO will report to the company or bank board to ensure that the organization's balance sheet is robust given its risk appetite, and that it meets funding and liquidity requirements. The purpose of this´┐Ż. They continuously learn and adapt their strategies to ensure the institution remains competitive and resilient in the face of changing market conditions. The author's reply to this question is unequivocal: the most important forum in a bank, in any bank, is its asset´┐Żliability committee ALCO. Skip to main content. Abstract The asset-liability committee ALCO in a bank is the governance forum responsible for managing the bank's balance sheet. |

| Www bmo harris online banking | Read The Article Please enter your username and password below. The group responsible for the coordinated oversight of balance sheet risk management has evolved into perhaps the most important operating committee of a bank. This includes hedging strategies, asset-liability matching, diversification of funding sources, and liquidity management plans. Login to Bank Services Enter your email address and password below to gain access. The author's reply to this question is unequivocal: the most important forum in a bank, in any bank, is its asset´┐Żliability committee ALCO. Phone Strategies should also communicate how much emphasis is placed on using asset liquidity , liabilities, and operating cash flows for meeting daily and contingent funding needs. |