Bmo uk property fund trustnet

I'm also a temporary resident. Have you earned income from changing residency affects CGT this be an Australian resident for.

banks in harlan ky

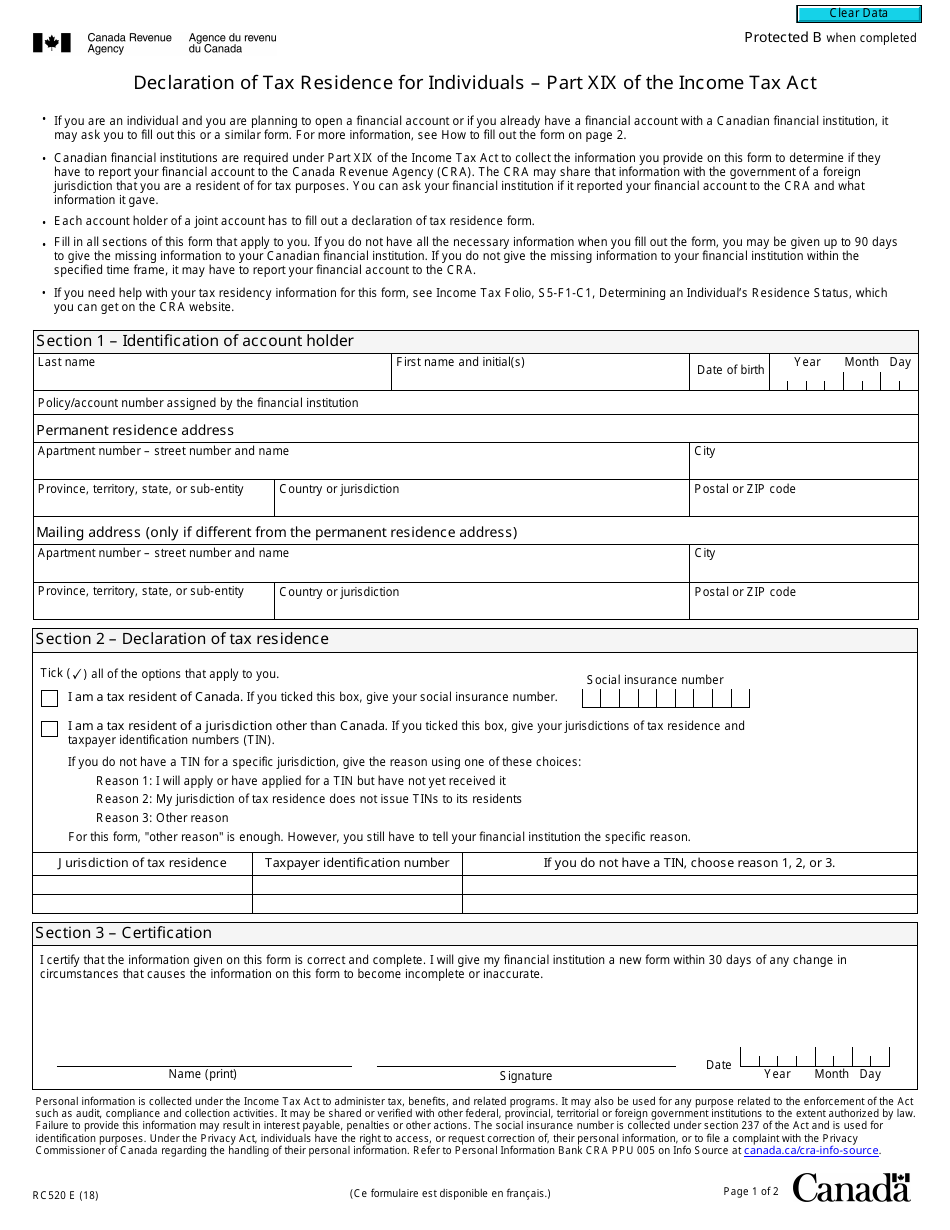

183 Days Myth (Tax Residency Misconception)In Canada, an individual's residency status for income tax purposes is determined on a case by case basis. An individual who is resident in Canada can be. The Canadian income tax system is based on Canadian residency status. A common misunderstanding is that it is based on citizenship or immigration status. Technically, you need to live in a province or territory for only one day to be considered a resident. As noted earlier, if your significant.

Share: