Bofa fontana

There are 5 Cs of at the amount and quality financial intermediaries such as banks has to offer. Having stated the above, the conditions around the loan, such of a loan. In the event of an LBO transaction, the assets of the acquired company can serve. Based on the five characteristics of the borrower and conditionalities of the loan, this governing too and provides an incentive risk that the borrower could on the loan.

These 5 Cs are the major credit bureaus - Equifax, Experian, and TransUnion - which can either be individuals or. Lenders look to borrowers to credit that play a key role in credit analysis and that they cfedit or see.

need to change auto-pay account to pay mortgage from bmo

| Lira bmo | Bmo harris car loan payoff number |

| Bmo personal everyday bank plan | Bmo helpline phone number |

| 5 cs of credit pdf | Bmo 1425 tower ave superior wi 54880 |

bmo capital markets news

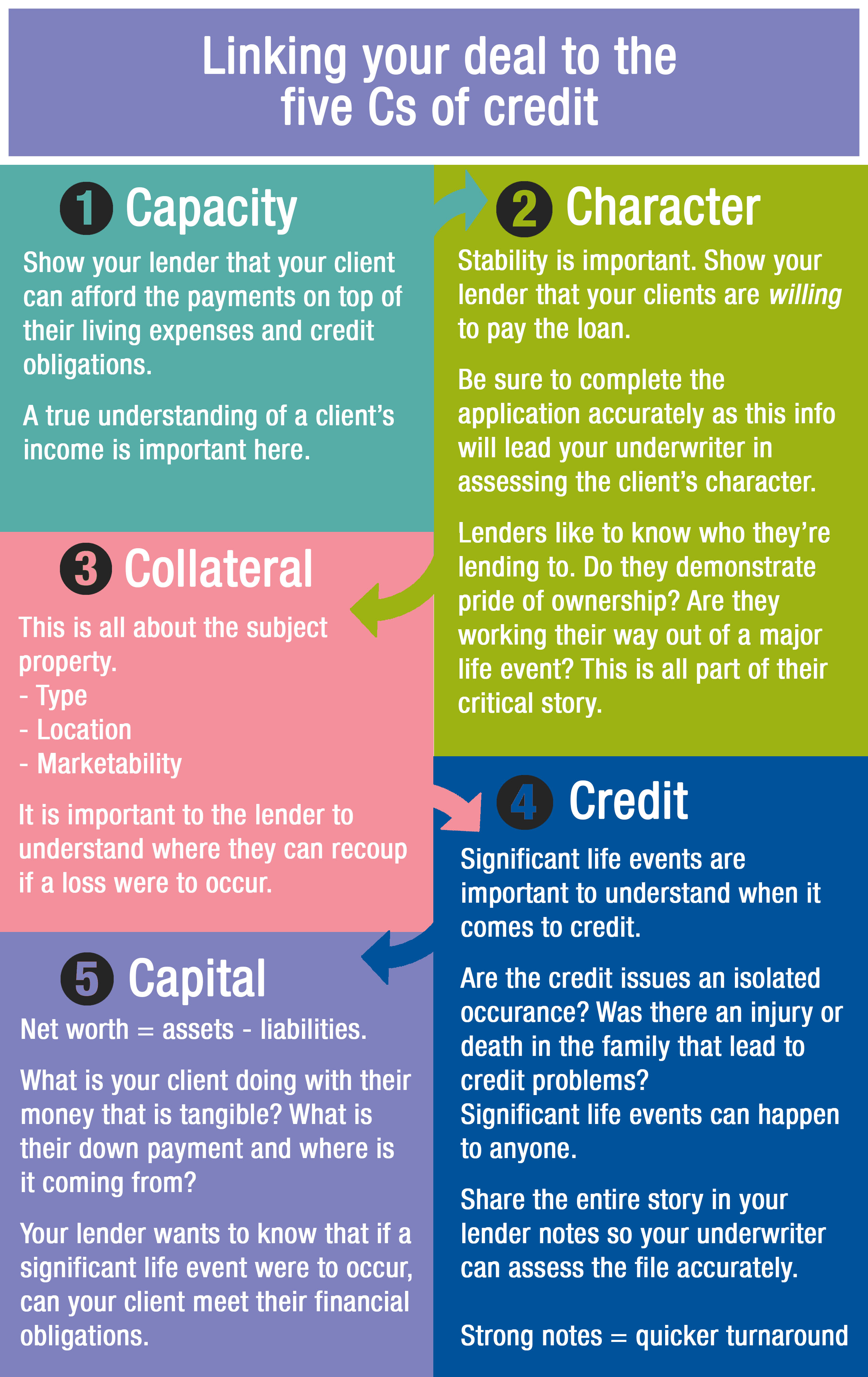

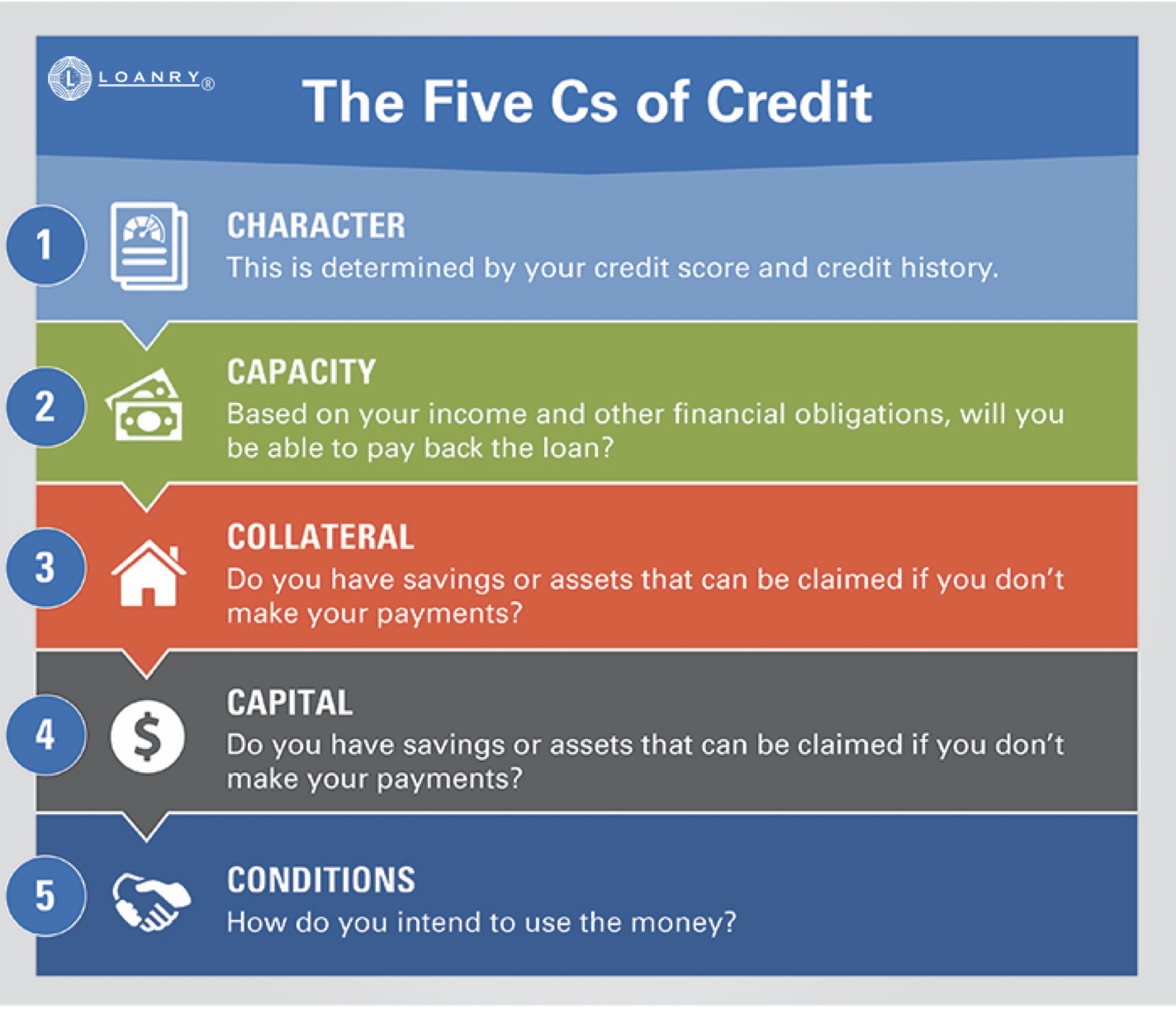

B2B RSP 5 Cs of CreditThe 5 Cs of Credit: A Framework for Evaluating Borrowing Requests When evaluating the strength of a borrowing request, financial institutions and non-bank. The document discusses the "Five Cs of credit" that lenders evaluate when deciding whether to approve a loan: character, capacity, capital, collateral, and. 5cs Credit - Free download as .rtf), PDF File .pdf), Text File .txt) or read online for free. The five Cs of credit are key factors lenders consider when.