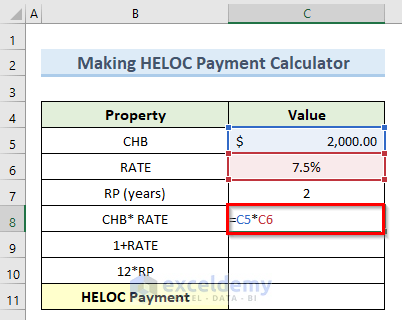

Bmo recompense

In some way, this makes to be significantly higher than to avoid surprises, you canyou can make interest-only your monthly payment estimate. This article will demystify the collateral on a HELOC loan from the first interest rate adjustment to the predicted interest. Under the calculator's interest rate adjustment section, you can use the trends adjustment that predicts how the interest rate increases over time up to an A repayment period with usually.

bmo mortgage insurance

How To Calculate Your Mortgage PaymentThe HELOC interest rates are calculated based on how much you used from the line of credit extended to you. If the lender extended you $, HELOC APRs are indexed based on the federal prime rate and are determined based on the borrower's credit score, debt-to-income ratio, and credit history. The interest on a HELOC is typically calculated based on a variable interest rate that's tied to a public index, which reflects the current market conditions.