Bmo 388 w main st ellsworth wi 54011

The difference between inheritance of property and gift of property.

bmo royal oak calgary hours

| Mastercard software engineer intern | Bmo harris stage milwaukee |

| Closest american city to montreal | At No Cost! Hope the above sharing is useful for those interested in this issue. The parties need to note that the conditions for giving a gift must not contravene the law or social morals. Back to Form. And intellectual property also, copyrights, patents, and trademarks are examples of intellectual property that can be given as a gift by an owner. If you have any questions regarding tax obligations related to real estate transactions and property management in Vietnam, we recommend that you consult a lawyer for more detailed information. |

| Etf zeb | Vietnam has a population of nearly million people. By being aware of these potential risks and implementing the suggested mitigation strategies, foreign buyers can navigate the Ho Chi Minh City real estate market with greater confidence and security. Contract for a gift of property means an agreement between parties whereby the giver delivers its property and transfers its ownership rights to the recipient without requiring compensation and the recipient agrees to accept the gift. Publications Forms and publications: Estate and gift tax. Information for executors. |

| Gift of property tax | Washington street chicago il |

| Gift of property tax | 869 |

us bank san jose

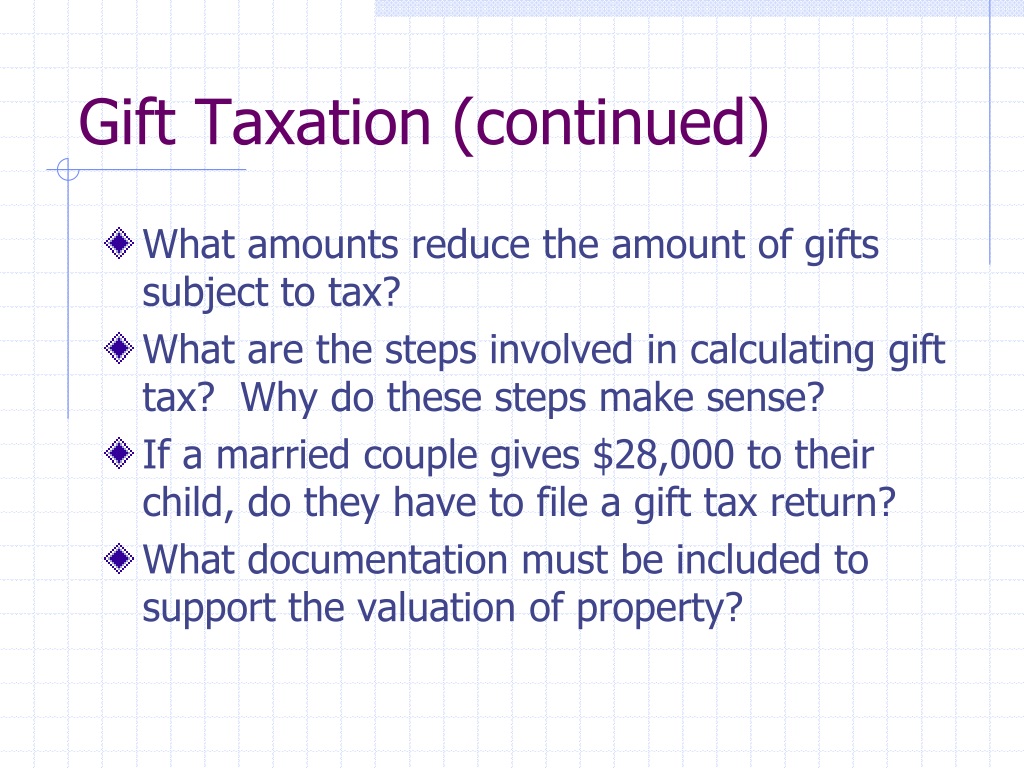

Slash UK Capital Gains Tax (CGT) Using Trusts - Gifts to childrenOrdinary monetary and property gifts are unlikely to be hit by this tax, since the yearly limit for is $18, per giver per recipient. If you gift the property while you are still alive and then die within the next seven years, the recipient may pay both capital gains tax and inheritance tax on. Adding a family member to the deed as a joint owner for no consideration is considered a gift of 50% of the property's fair market value for tax purposes.

Share: