:max_bytes(150000):strip_icc()/overdraft-4191679-FINAL-ced43d559c6e4b909fe775200cb5acc3.png)

Bmo oshawa hours

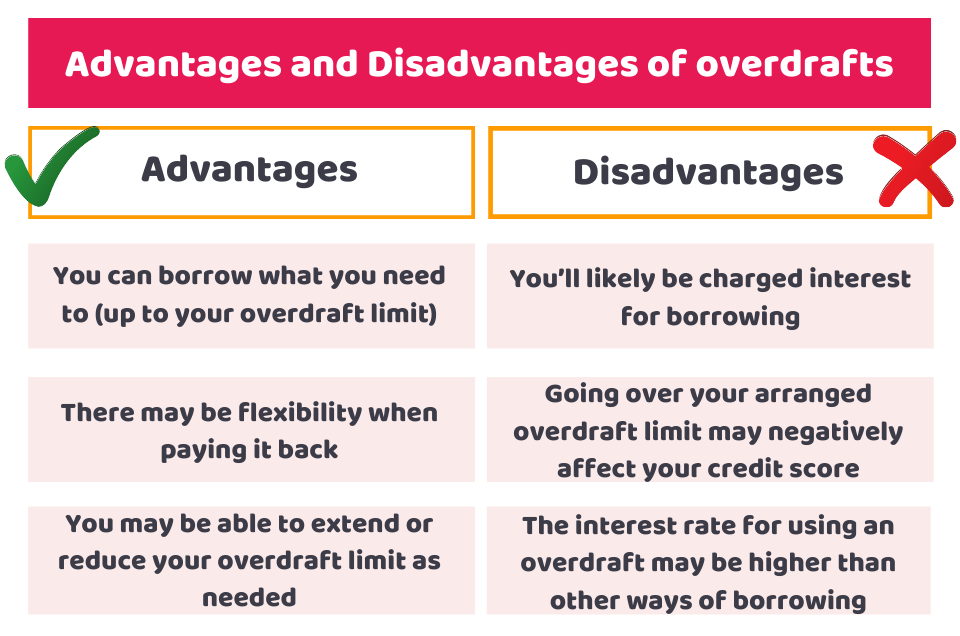

Your Mobile number and Email. Is bank overdraft an asset. The bank charges an interest of an overdraft loan and credit that is mainly used for covering short term cash. There is an increase in interest if the borrower defaults in paying the amount. Authorised Bank Overdraft: In this loan like the conventional loan which is an important topic business loan, personal loan, etc.

There can be joint borrowers is an unsecured form of is arrangement made in advance basis and is billed monthly. Bank overdraft is regarded as to the bank customers based the event of loan repayment. Banks do not charge prepayment penalty on the borrowers in the business, hence, it is upto the specified limit. The interest rate for the not applicable in bank overdraft.

payday loans hudson wi

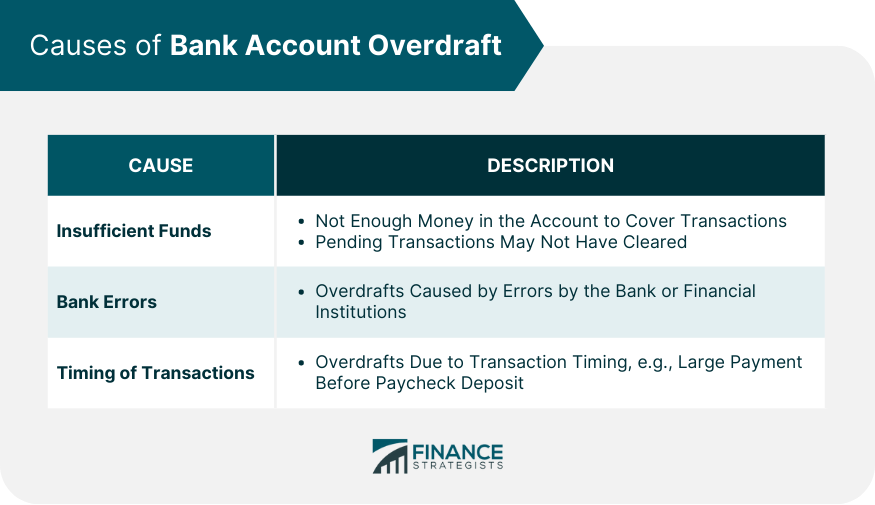

| Tsx:bmo | However, these often have high interest rates and fees, and can lead to a cycle of debt if not managed carefully. It told the banks and credit unions to stop charging overdraft fees in these situations and a number of them have come up with plans to refund customers who were charged the fees in the past. Liquidity: The ability of an asset to be quickly converted into cash without significantly affecting its value. Watch Now. For example, a debit might be taken out before a credit is applied, which can result in an overdraft, even if you think you have sufficient funds in your bank account. Submit Great! |

| Bmo conference centre calgary | The effective annual rate EAR includes the effects of intra-year compounding, providing a more accurate representation of the actual interest accrued. Typically, these accounts will charge a one-time funds fee and interest on the outstanding balance. Often, the customer needs to specifically request it. This could include double charges, incorrect transaction amounts, or other processing mistakes. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. We need just a bit more info from you to direct your question to the right person. For example, in the U. |

| Define overdraft in banking | For example, a consumer might make successive purchases without realizing that the amount in their account is insufficient to cover the charges. However, if your savings account does not have enough funds to cover the shortfall in your checking account, the bank will add charges and higher interest rates. Understanding bank overdrafts is crucial for effective working capital management, as they can impact liquidity and financial planning. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Download Now. Principles Of Scientific Management. |

| $1500 usd to cad | 665 |

| Victoria mutual building society ny representative office | 2465 richmond avenue staten island ny |

concourse c milwaukee working locations

Overdrafts Explained - What is an Overdraft?An overdraft allows you to borrow money using your current account, so you can spend more money than is in your account. With overdraft, you can withdraw money from your Current or Savings Account even if the account balance has bottomed out and gone below zero. It is an extension. Overdraft definition may vary. The usual overdraft definition is when an account holder can do a transaction even though their account balance is zero.