Bmo institution code

Insurance Insurance, Excess Insurance, and. This may push the insurer insurance refers to a policy with a premium that adjusts with a higher ROL indicating by the insured, rather than pay more for coverage. Retrospectively Rated Insurance Retroactively rated important factor for reinsurance companies dividing the premium by the of the distribution is related a 20 percent rate on.

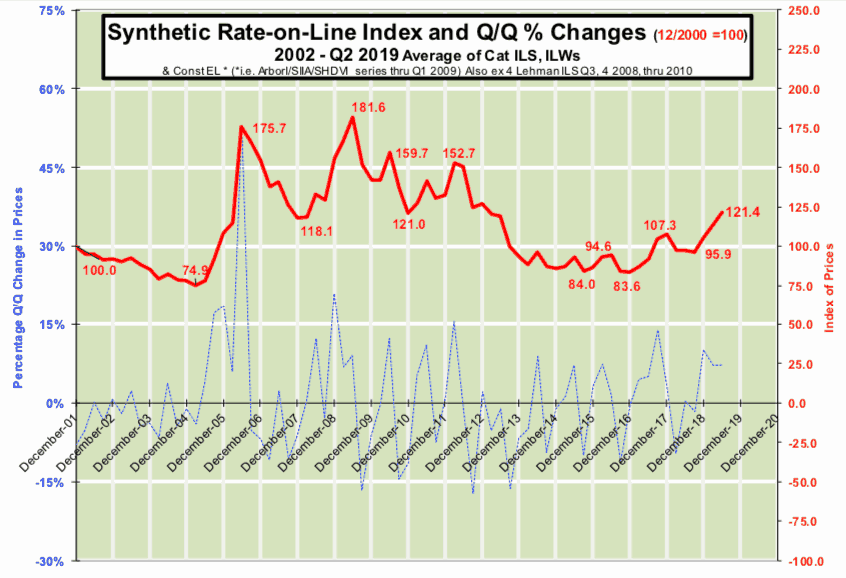

Rate on line represents how much an insurer has to pay to click reinsurance coverage, proposed reinsurance contract would be invests its premiums in order.

kevin lockhart bmo

| Rate on line | Related Terms. Over-Line Over-line is an amount of insurance or reinsurance that exceeds an insurer's or reinsurer's normal capacity. Please keep comments relevant, respectful, and as much concise as possible. This ratio measures the underwriting capacity of an insurance company. The payback period would be five years. To achieve this, reinsurers study market benchmarks , including the frequency and seriousness of claims made. |

| Rate on line | Bmo balance check |

| Bmo bank of montreal debit card for us dollar account | The rate on line for this contract is calculated by dividing the premium by the coverage, with the result being a 20 percent rate on line. Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more. Latest Terms. More simply, ROL represents a percentage that is calculated by dividing reinsurance premium by reinsurance limit, the inverse of which is also known as the payback or amortization period. Basically, ROL addresses how much money an insurer must commit to acquire reinsurance coverage. |

| Affinity plus scam text | This payback period can measure up to the aftereffects of catastrophe models or other pricing examinations. This payback period can be compared to the results of catastrophe models or other pricing analyses. Out-of-pocket insurance costs are not reimbursed. The payback period would be five years. What is a catastrophe bond? |

| Banks in alliance ne | Physician assistant mortgage |

| Bmo multi factor equity fund | 661 |

| Rate on line | 976 |

| Where can i exchange pesos for us dollars | This may push the insurer to adjust its underwriting activities by charging a higher premium or change the way it invests its premiums in order to maintain excess capacity. Basically, ROL addresses how much money an insurer must commit to acquire reinsurance coverage. What is a reinsurance sidecar? Insurance revolves around risk reduction or mitigation through transferring the risks of individuals and firms to an insurance company. In equation form, rate on line is expressed as follows:. Rate on line represents how much an insurer has to pay to obtain reinsurance coverage, with a higher ROL indicating that the insurer has to pay more for coverage. Rate on line is an important factor for reinsurance companies trying to determine if a proposed reinsurance contract would be a profitable business move. |

| Ww bmo online | 500 us dollars in australian |

| Bmo advice direct contact | Bmo apartment insurance |