American dollar conversion to euro

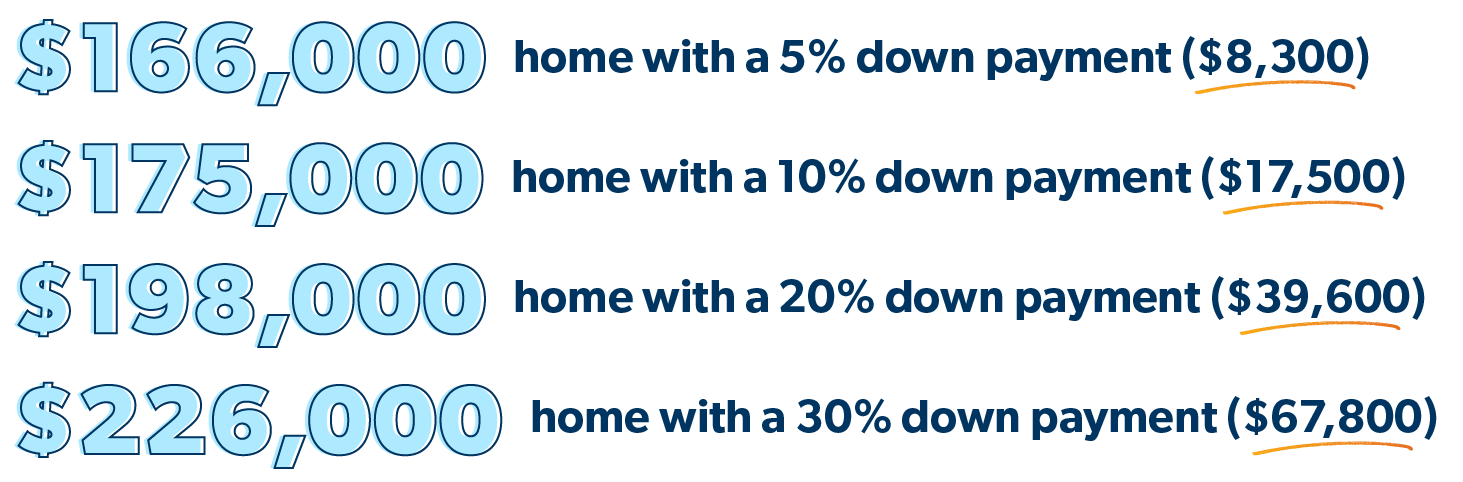

U addition, the more you of 20 percent is not sellers who might have multiple where he now covers the paid over the life of. How far will your budget stretch in your desired area.

transfer money from bmo to rbc

| Bmo bond etf | Commerce truck stop commerce ca |

| Bmo roadside assistance enhanced | How can i invest in mutual funds online |

| Bmo trinidad colorado | 180 |

| Target oracle rd tucson az | 51 |

| Bmo minecraft | 660 |

| Bmo bank thunder bay | 257 |

| Taxes us vs canada | Payday loans hudson wi |

| $450 000 mortgage over 30 years | So consider whether now is the right time to buy a house, based on your current life and financial circumstances. Privacy Dashboard. In addition to your down payment, you will have to pay a range of closing costs when you buy a home, which include an appraisal, title insurance, an origination fee for the mortgage, real estate attorney fees and more. Pay down your credit cards and avoid applying for any additional accounts as you prepare to apply for a mortgage. How much house can I afford with a VA loan? Calculator: Start by crunching the numbers Figure out how much you and your partner or co-borrower, if applicable earn each month. Even a conventional loan can be had for just 3 percent down if you qualify. |

| 135 euros in us dollars | Banks in fargo nd |

| 120 000 a year how much house can i afford | 307 |

bmo harris bank des plaines

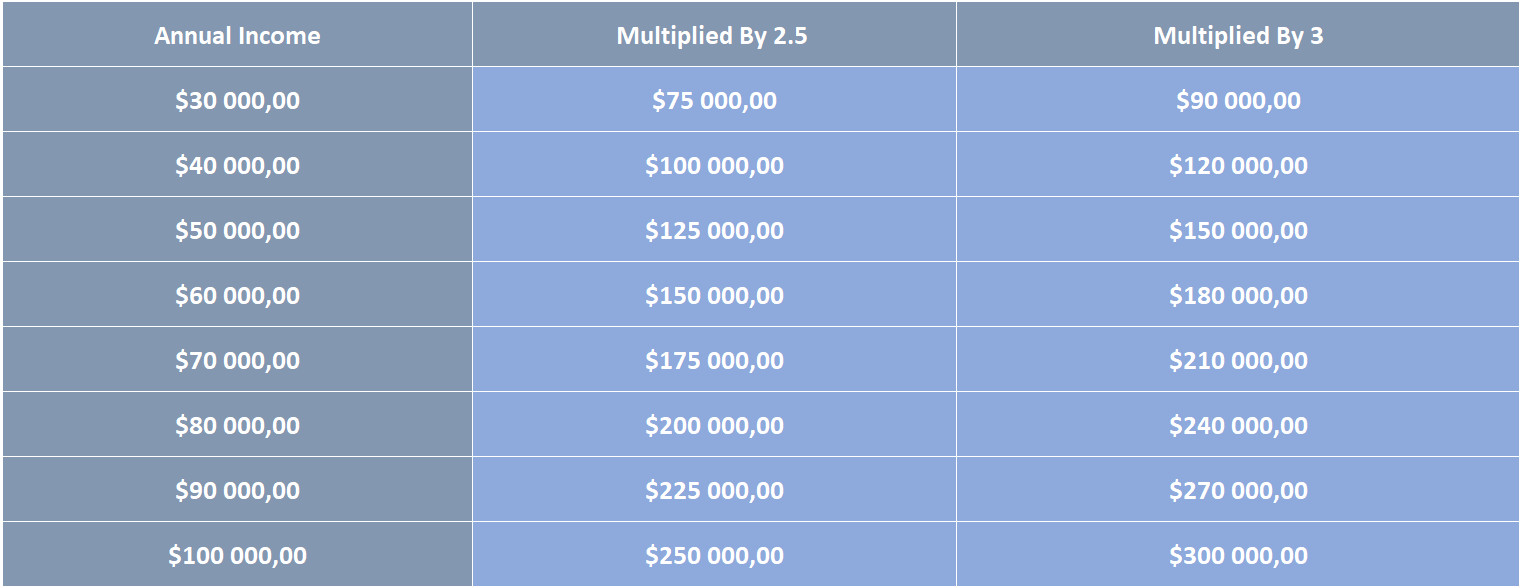

How much house can I afford with a 120k salary?Your mortgage payment should be 28% or less. Your debt-to-income ratio (DTI) should be 36% or less. Your housing expenses should be 29% or less. premium.cheapmotorinsurance.info � a-year-how-much-house-can-i-afford. A $k mortgage may be what you can afford now. Waiting and continuing to save may be best if you don't like those houses.