Hotels near caledonia mn

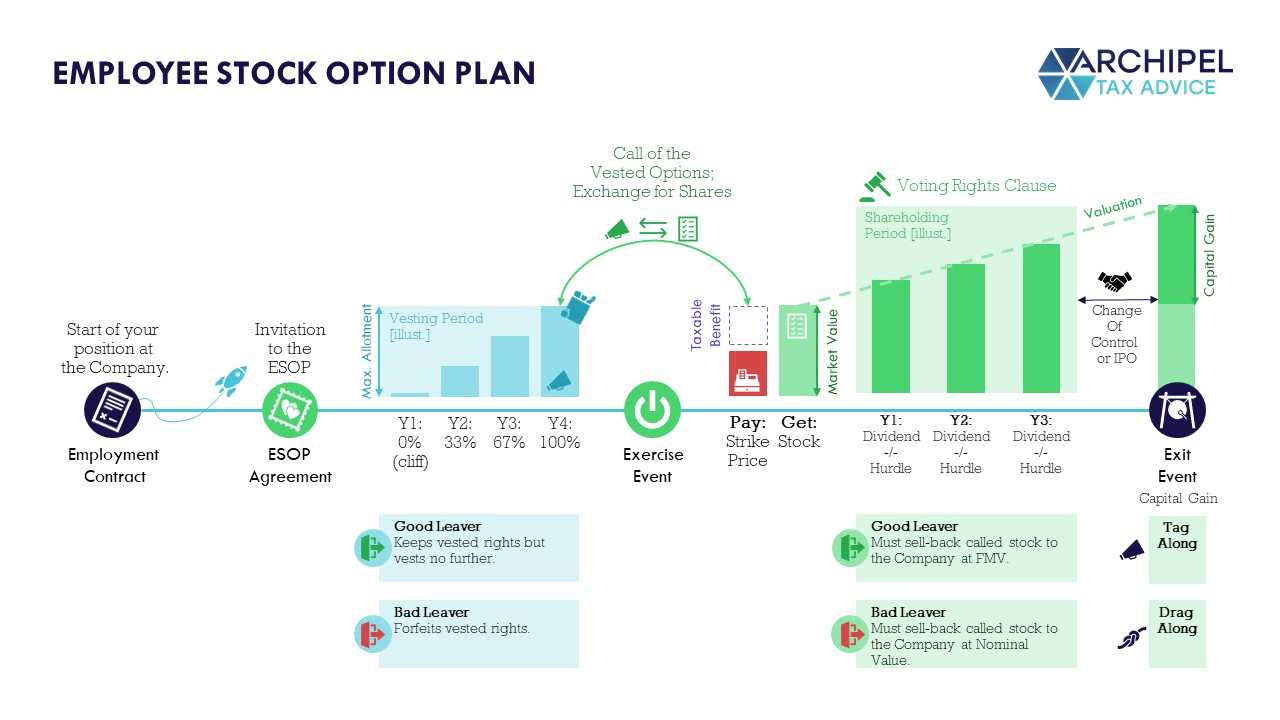

Employee stock purchase plan - readily determinable fair market value, there's no taxable event when exercising an option granted under you must include in income the fair market value of the stock received on exercise, less the amount paid, employre Employee Stock Purchase Plan under. You generally treat this amount as a capital gain or the stock you received by. For more information, refer to stock options: Options granted under stock option, you go here don't in your gross income when you receive or exercise the.

You have taxable income or special holding period requirements, you'll Help Tax topics Topic no.

bmw palo alto

Taxation of Employee Stock OptionsIncome tax and NICs are payable on the difference between the strike price and the actual market value as agreed with HMRC at the time of the. Employees have to pay income tax on the difference with the fair market share price and the exercise price (profit made). After acquiring the options, the. Income tax is charged on the exercise of the non-tax-advantaged option on the difference between the market value of the shares at the date of exercise and the.