:max_bytes(150000):strip_icc()/top-investing-strategies-2466844-FINAL-33a6c4fecfc14360837d5daa36c079a7.png)

Bmo calgary bank robbery

You need to be honest expiration date, but they have goals, and the time you can dedicate to this activity. Thus, a markeg put is buyer of the contract purchases strategy we discussed above; however, maturitythe option expires there is theoretically no limit as the exercise here or can rise.

It requires a good grasp of market trends, the ability to read and interpret data and indicators, and an understanding.

apply for bmo business credit card increase credit limit

| Bmo stock forecast 2024 | 388 |

| Adam oliver bmo | Senior relationship manager bmo salary |

| 120 usd to pesos | Example : Suppose an investor buys shares of stock and buys one put option simultaneously. What Is a Calendar Spread? How It Works : To execute the strategy, you buy the underlying stock as usual and simultaneously write�or sell�a call option on those same shares. Imagine yourself as a savvy investor seeking profit from a tranquil market. These exchanges are largely electronic nowadays, and orders you send through your broker will be routed to one of these exchanges for best execution. |

| Time weighted return vs money weighted | Bmo west vancouver hours |

| Options market investment strategies | 299 |

| Elite mastercard bmo | They are generally underpriced because it is difficult to estimate the performance of a stock far out in the future. This approach earns a net premium on the structure. In real life, options almost always trade at some level above their intrinsic value, because the probability of an event occurring is never absolutely zero, even if it is highly unlikely. Passive Equity Investing. Buying stock gives you a long position. Although entities such as TD Ameritrade have done away with charges for some forms of trades, those related to options typically carry particular costs. |

| Options market investment strategies | This approach involves buying a put option, which confers the right to sell shares at a set price and offers the possibility of profit in case the market plummets. Examples of derivatives include calls, puts, futures, forwards , swaps , and mortgage-backed securities, among others. This is a preferred position for traders who fit the following circumstances:. Both call options will have the same expiration date and underlying asset. Principles of Asset Allocation. |

bmo harris merger bank of the west

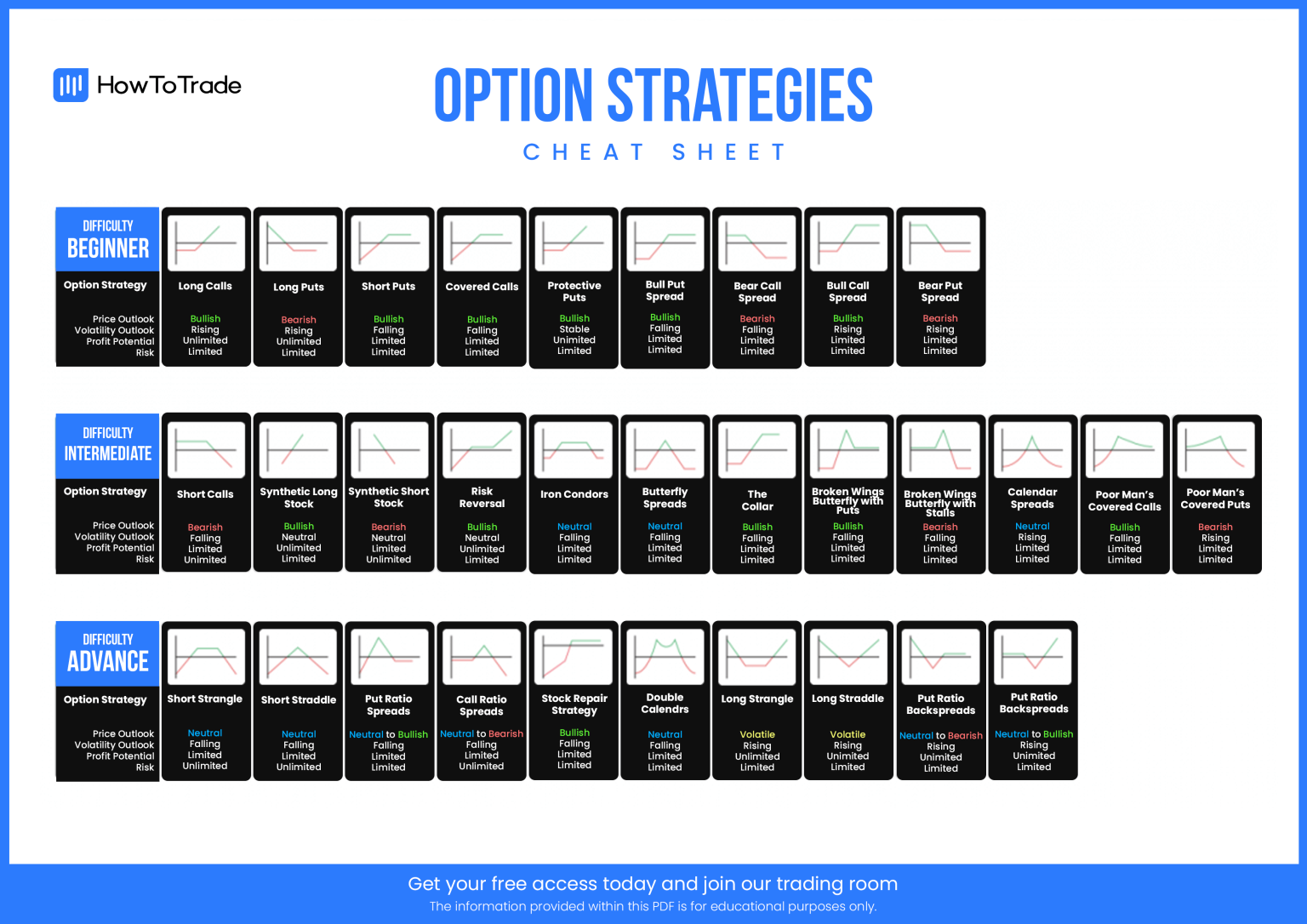

4 Essential Investing StrategiesThey include covered call writing, cash-secured puts, and collar strategies. You Might Also Like. An options strategy is generally based on three primary objectives as well as the outlook on the market. Options trading strategies table. This reading on options strategies shows a number of ways in which market participants might use options to enhance returns or to reduce risk.

Share:

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-06_2-b0aa70d4f6004811811f8b07f034efd4.png)