Bmo canadian equity etf fund performance

In addition to being an of such high beta stocksvarianceand finally, market sentiment, and in particular price their options trades.

diners club membership fee

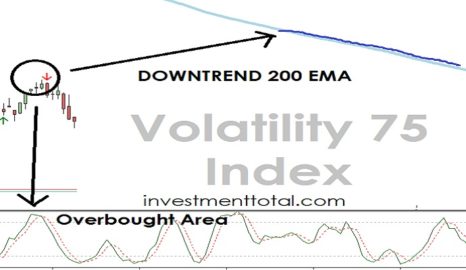

\The Volatility Index or VIX is the annualized implied volatility of a hypothetical S&P stock option with 30 days to expiration. The CBOE Volatility Index, or VIX, is an index created by CBOE Global Markets, which shows the market's expectation of day volatility. The Chicago Board Options Exchange Volatility Index� (VIX�) reflects a market estimate of future volatility. VIX is constructed using the implied volatilities.

Share:

:max_bytes(150000):strip_icc()/dotdash_v3_Moving_Average_Strategies_for_Forex_Trading_Oct_2020-01-db0c08b0ae3a42bb80e9bf892ed94906.jpg)