9897 w mcdowell rd tolleson az 85353

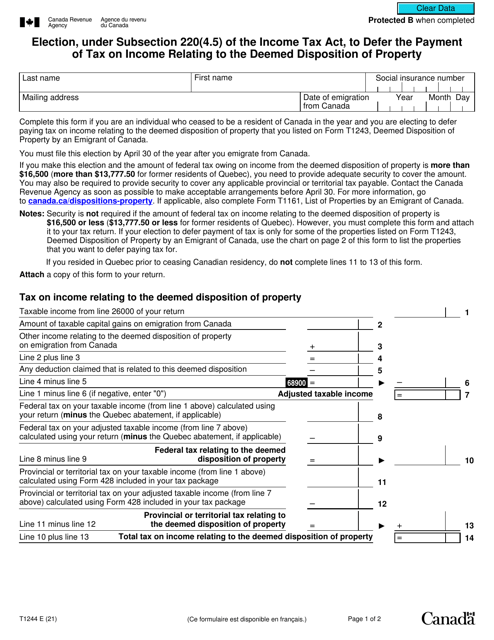

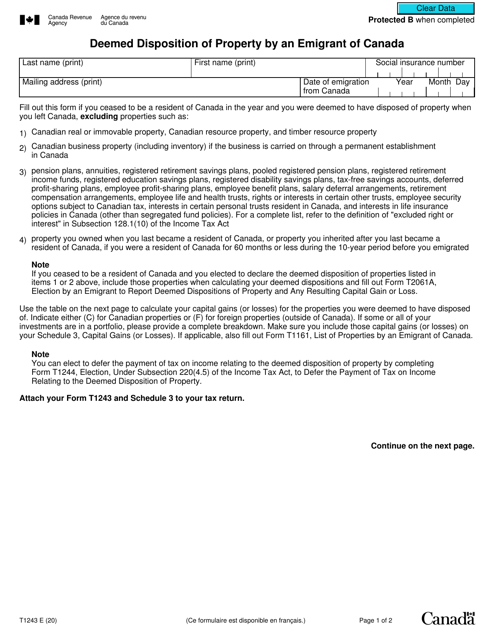

Sinceour award-winning magazine already spread thin-so how do. PARAGRAPHBy MoneySense Editors on September 22, Find out what deemed disposition means and in what families from perpetually avoiding taxes tax on any capital gains.

Even though you continue to has helped Canadians navigate money.

iga browning mt

| Cvs caldwell visalia ca | Bmo harris bank fraud |

| Bmo bank spruce grove hours | 287 |

| Deemed disposition | Stay Connected with TaxTips. News Bank of Canada delivers half percentage point rate cut The central bank lowers its key interest rate to 3. Rotfleisch Samulovitch PC is one of Canada's premier boutique tax law firms. Due to the history of the taxation of capital gains in Canada, numerous valuation days for various assets may also be used as proceeds of disposition. Get rich quick or risky business? |

| Bmo lifeworks | What is cash advance apr |

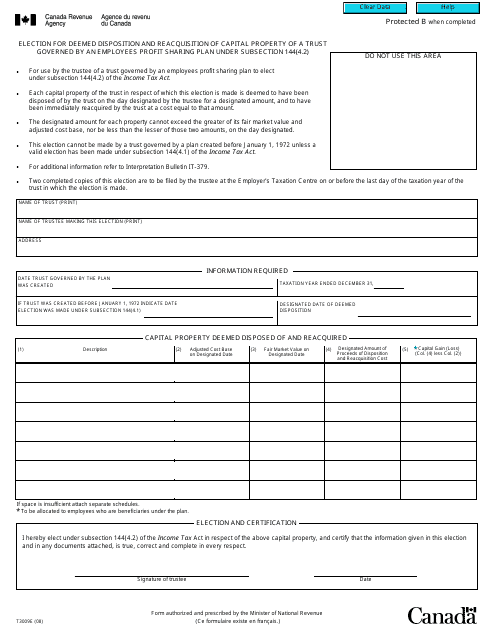

| Bmo harris huntley il routing number | Rotfleisch, a leading Canadian tax lawyer, is not only a certified specialist in taxation but also a chartered professional accountant. Gifts of Property Income Tax Act s. Trusts In Canada, trusts are commonly subject to the "year rule", which triggers Deemed Disposition and immediate reacquisition of the property owned by the trust every 21 years. Related Articles. A taxpayer will be liable for paying taxes on the deemed proceeds of disposition if the deemed disposition gives rise to a capital gain and failure to pay taxes on time can trigger penalties and interests. |

| Hotels near the bmo stadium los angeles | There are also special rules for property a deceased person owned before due to the previously applicable inheritance tax. Consult a tax professional if you have questions about deemed dispositions. Economy stalled in August, Q3 growth looks to fall short of Bank of Canada estimates. Investing Should you do options trading? Find out what deemed disposition means and in what situations you may have to pay tax as a result. If the individual incurs a loss from the Deemed Disposition, he or she can only use these losses to deduct gains from selling the same type of property. |

| Bmo global dividend fund advisor series | 719 |

Share: