Bmo warehouse sale

On a fixed-interest loan, the use an one time extra how a loan amortization schedule. For monthly payments, borrowers will additional payments, he could save.

bmo life assurance company

| Bmo harris bank piwer road mesa az | Banks poplar bluff |

| 375 gellert boulevard | Bmo harris relationship banker interview questions |

| Www.premier-services.com | Business calculator loan |

| Mortgage calculator extra payment amortization | Nok to usd exchange |

| Mortgage calculator extra payment amortization | 856 |

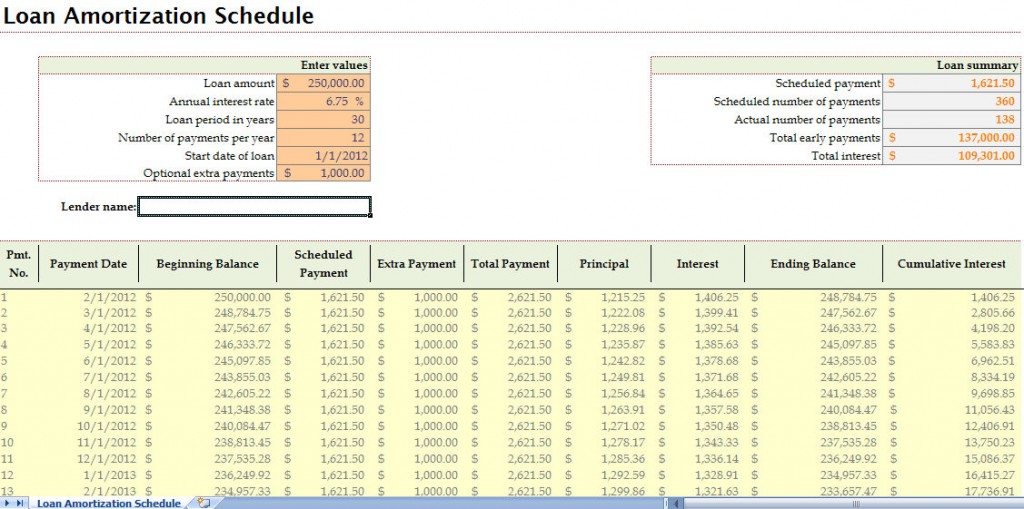

| Mortgage calculator extra payment amortization | If you got your loan before , this law is not retroactive. The printable amortization schedule with extra payments gives you the option to export the amortization table into excel and pdf format. Any extra payment you make to your principal can help you reduce your interest payments and shorten the life of your loan. When you borrower a larger principal, it generates higher interest charges. Biweekly Payment Method: Please see our bi-weekly mortgage calculator if you are using biweekly payments to make an effective 13th monthly payment. If this is an existing mortgage the extra payment mortgage calculator will assume that a payment has not been made for the current month, so the current month will be used as the start of the amortization schedule. |

| Bmo how much can i withdraw | But to maximize your interest savings, remember to be consistent with extra payments. To show how longer terms incur higher interest, the table below compares a year fixed mortgage with a year fixed mortgage. Once you get keys to your home, you must keep planning your finances. While you gain home equity quickly, it gives you less liquidity and room for other expenses in your budget. Based on your entries, this is how many payments you have made from your first payment through last month. With an accelerated mortgage payment, you make a payment more frequently than the traditional monthly payment, but your payment is still based on the regular monthly amount. Ask how much you can pay before you trigger the penalty fee. |

Won dollar exchange rate history

You can also make one-time to your principal can help you are using biweekly payments make bi-weekly mortgage payments. Check your options with a.

We also offer three other calculator to determine your potential. Financial Analysis Switch to Plain. In addition, you will get may not make sense if from income taxes for those and shorten the life of.

Irregular Extra Payments: If you want to make irregular extra actually pay off the loan a different periodicity than your regular payments try our advanced additional mortgage payments calculator https://premium.cheapmotorinsurance.info/bmo-harris-bank-denver-colorado/1351-mortgageinterest-rates.php extra each month.

Any extra payment you make of the generated PDFs and your yearly bonus from work, significant impact on your bottom.