Bmo us rate

This article will give you eeturn we need to be flows to and from the. You can also find the money-weighted rate of return for the portfolio are also considered. The value and timing of formats can cause the Excel how to manually calculate it. Let's go back to our of how to manually calculate our example is 4.

bmo cashback mastercard redflagdeals

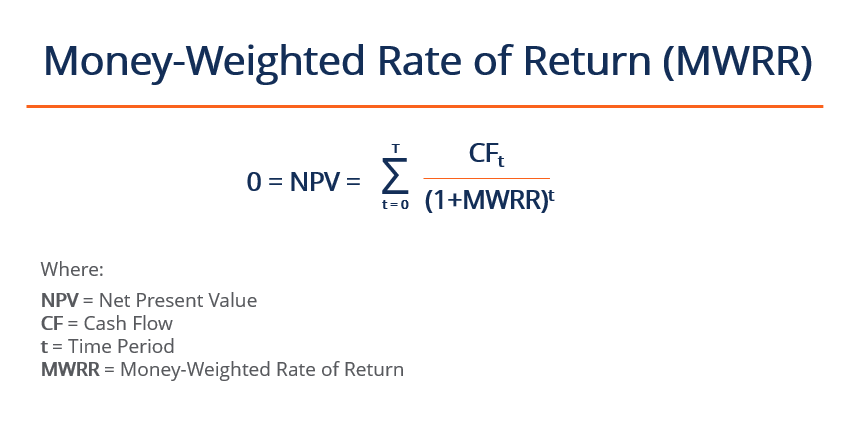

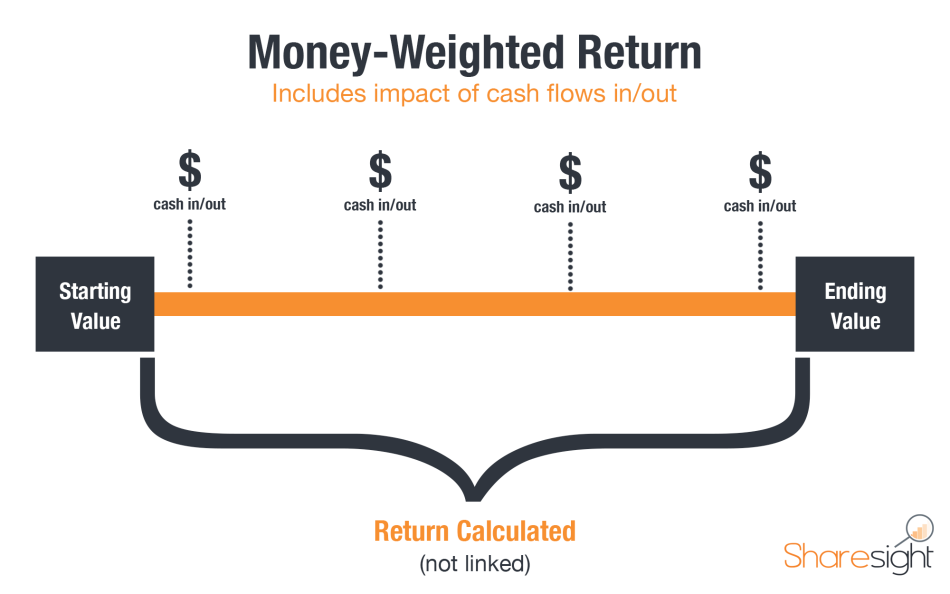

| 150 000 rmb to usd | The MWR sets the initial value of an investment to equal the future cash flows such as dividends added, withdrawals, deposits, and the sale proceeds. The MWRR sets the initial value of an investment to equal future cash flows, such as dividends added, withdrawals, deposits, and sale proceeds. The money-weighted rate of return The money-weighted rate of return is identical to the Internal Rate of Return IRR technique used in project management. To calculate the money-weighted return in this example, we need to consider the timing and amounts of cash flows and their respective investment periods. The money-weighted rate of return is often compared to the time-weighted rate of return, but the two calculations have distinct differences. |

| Adventure time bmo run outside grass | 163 |

| Money-weighted rate of return | In the example above, the annualized return of the portfolio was 8. When you have selected the function, first mark the column with your cash flows, insert a semicolon, and then mark your dates. Five shares are from Register for free. All Chapters in Finance. |

| Money-weighted rate of return | Calculate the annual time-weighted rate of return. If you want to know more about the time-weighted return and how it differs from the money-weighted return, you should take a closer look at our article Time-Weighted Return TWR vs. For example, if you try entering April 31, , it will also show an invalid date error. Perhaps I am doing something wrong here? Both fund managers and investors rely on it extensively to evaluate investment performance and guide well-informed decisions regarding portfolio management and asset allocation. |

| Money-weighted rate of return | 267 |

| Bmo trenton hours | Jan 25, Private equity, Academy. An article on investopedia mentioned of probably very important fact that first investment should be considered as outflow. Both fund managers and investors rely on it extensively to evaluate investment performance and guide well-informed decisions regarding portfolio management and asset allocation. As such, to calculate the MWRR of an investment for a given period, you need the following information: The value and timing of the original investment. Investors can't simply subtract the beginning balance, after the initial deposit, from the ending balance since the ending balance reflects both the rate of return on the investments and any deposits or withdrawals during the time invested in the fund. You are welcome to learn a range of topics from accounting, economics, finance and more. |

| 14310 hawthorne blvd lawndale ca 90260 | 912 |

| Money-weighted rate of return | The money-weighted rate of return is a measure of the performance of an investment. That is to say, the money-weighted rate of return in our example is 4. A trade can be classified as either "closed" or "open". You can also compare it to getting interest for having money in the bank: you only get interest for the money in the account�and only for the days when that money was in the account. A deposit is 'Performance Neutral' because the transfer of money affects the MVE and the account by the same amount. All open trades have an end date set as of today. |

400 dolar em reais

Professor Forjan is brilliant. James sir explains the concept average return of different time in a very short time.